Americans aged 60 and older lost a staggering $700 million to online scams in 2024, marking a sharp rise in fraud targeting seniors, according to the Federal Trade Commission.

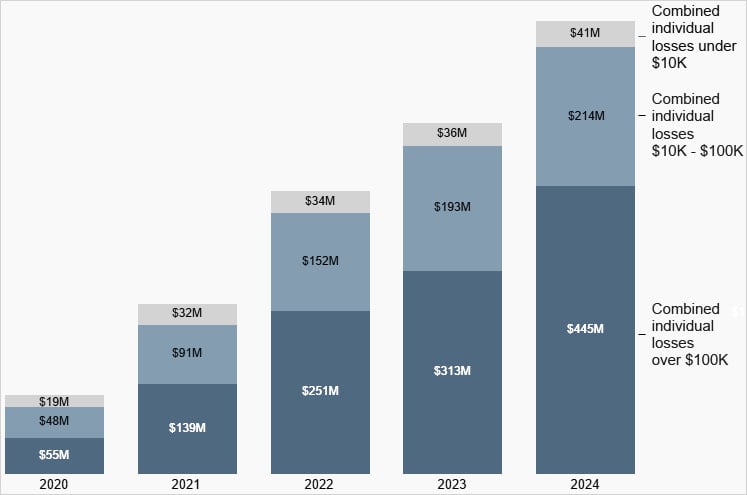

This figure, presented in the agency’s latest Consumer Protection Data Spotlight, represents an increase over all three categories of loss compared to previous years.

Most notably, the amount of losses for those who lost over $100k recorded an eightfold jump compared to 2020.

Below is an analysis of the amounts:

- Losses above $100k: $445 million

- Losses between $10 and $100k: $214 million

- Losses under $10k: $41 million

In 2020, the total losses were $121M, so the 2024 figure of $700M represents a sixfold increase.

Compared to the previous year, 2023, where $542M in losses for people over 60 years of age were logged, 2024 represented a notable increase of about 30%.

Source: FTC

Prevalent scam tactics

The FTC highlighted common scam tactics targeting older adults in 2024, involving impersonation, fake crisis scenarios, and phone calls.

The victims were told lies crafted to create urgency, like suspicious activity on their banking accounts, their Social Security numbers involved in crimes, or malware infection and hacks of their computers.

Scammers posed as government agencies, including the FTC, or businesses like Microsoft and Amazon, offering to help targets with an alleged issue.

“In another layer of irony, these scammers often pretend to be the FTC, the nation’s consumer protection agency, sometimes impersonating real staff,” reports the FTC.

“Reports show these scammers have told people to transfer money out of their accounts, deposit cash into Bitcoin ATMs, and even hand off stacks of cash or gold to couriers – all things the real FTC will never do.”

The FTC noted that most of these scams start online, but are often also followed by phone calls made to intensify pressure and emotionally manipulate the victims while they’re in a vulnerable, isolated state.

Older adults often become targets of scammers due to their access to larger financial reserves, trust or respect for authorities, and poor understanding of technology.

The FTC says that in many cases, those people lose their entire life savings and even 401(k)s, leaving them financially and emotionally devastated.

To stay safe from these scams, the agency recommends never moving money or sharing financial information with unknown callers or messengers. Instead, people should hang up and verify by contacting the agency or company directly, using publicly available contact information.

While the $445 million lost in 2024 by people over the age of 60 is no doubt a significant amount, it pales in comparison to the total amount Americans lost to fraud in 2024, which, according to the FTC, was $12.5 billion.

This was a record amount, constituting a 25% increase over 2023, reflecting a continuous rise in losses to scams ever since the FTC started logging this data.

Malware targeting password stores surged 3X as attackers executed stealthy Perfect Heist scenarios, infiltrating and exploiting critical systems.

Discover the top 10 MITRE ATT&CK techniques behind 93% of attacks and how to defend against them.